The UK property market has seen its fair share of volatility over the years. From economic fluctuations to political changes, these uncertainties can make some investors hesitant. However, a volatile market shouldn’t deter you from property investment. In fact, investing during a volatile period can offer unique advantages and opportunities. In this article, we’ll explore the advantages of investing in the current UK property market and how you can navigate these uncertain times.

Understanding the Nature of a Volatile Property Market

Understanding the dynamics of an unpredictable property market is essential before making an investment. Numerous variables, including the state of the economy, interest rates, governmental regulations, and world events, can have an impact on the market’s volatility. It is essential to remain knowledgeable about these elements and how they could affect the market for property.

Comprehensive Market Research

Market research must be done thoroughly before making any investments. Insights on market stability and development potential can be gained by examining historical trends, market data, and local demographics. Investors might find untapped opportunities by identifying new neighborhoods or locations with potential.

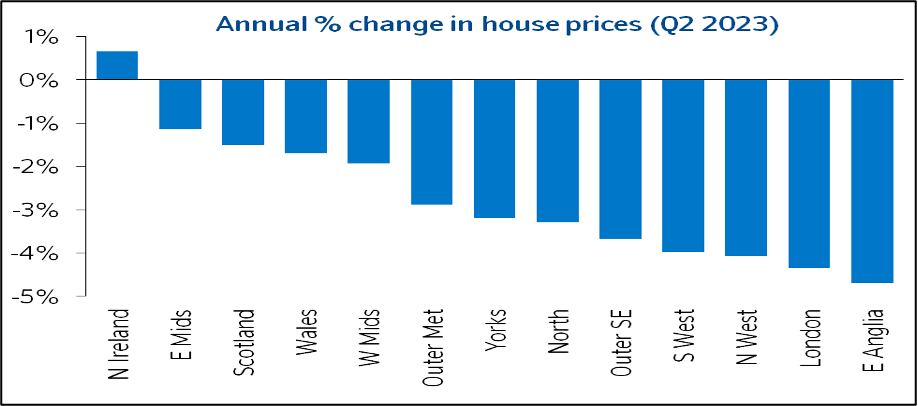

Potential for Lower Property Prices

During periods of market volatility, property prices can experience downward pressure. Nationwide reported that prices have fallen by -3.5% over the lase 12 months. This presents an opportunity for investors to acquire properties at potentially lower prices than during more stable market conditions. By capitalizing on these market dips, you can secure properties with greater potential for long-term capital appreciation.

Increased Negotiation Power

When the market is uncertain, sellers may be more open to negotiation. They may be willing to consider lower offers or offer more favourable terms to close deals. As an investor, you will have an opportunity to negotiate favourable purchase prices, better rental terms, or other incentives that can enhance your investment returns.

Higher Rental Yields

A volatile market can result in increased rental demand. Economic uncertainty leads people to opt for renting instead of buying, driving up rental demand. This increased demand can allow you to secure higher rental yields and achieve stronger cash flow from your property investments.

Embracing Risk Management Strategies

In a volatile property market, managing risks becomes even more critical. Diversification, for instance, can help mitigate the impact of market fluctuations by spreading investments across different property types or geographic locations. Employing a long-term investment strategy, rather than focusing on short-term gains, can also help weather market volatility.

Capitalizing on Distressed Properties

Distressed properties, such as foreclosures or houses in need of rehabilitation, can offer appealing investment opportunities during times of market volatility. These homes are sometimes undervalued and can be bought for a lower price, giving investors the chance to renovate or sell them for a profit.

Long-Term Growth Potential

While market volatility may create short-term fluctuations, the UK property market has historically demonstrated long-term growth. Investing during a volatile period allows you to position yourself for future market recoveries and benefit from the potential upside. Savills forecasts property values to rise by an average of over 13% over the next 4 years. Thus, by adopting a long-term investment approach, you can ride out short-term market fluctuations and potentially enjoy substantial capital gains over time.

Conclusion

In conclusion, investing in a volatile UK property market can offer unique advantages for savvy investors. By staying informed, conducting thorough research, lower property prices, increased negotiation power, higher rental yields, embracing risk management, capitalizing on distressed properties, and long-term growth potential are among the benefits you can harness during uncertain times. Keep in mind that while volatility could bring risks, it can also open the door to large profits for smart property investors.

Navigating a volatile market requires careful research, due diligence, and a well-defined investment strategy. Consider working with experienced professionals who can provide market insights and guide you through the investment process.